These benefits are offered to employees to help them work more productively and reduce stress. You will need to calculate the exact Gross Income of employees and tax deductions from Net Income. Payroll processing is an essential part of any company and must be done with the utmost dedication. For those looking to build a loan management system, integrating robust payroll software can streamline financial operations and enhance overall efficiency. The payroll software was developed over time to handle the tedious task of payroll processing with just a few clicks. The software offers many benefits such as employee tracking, benefits deduction, salary disbursement accuracy and timely, and benefits tracking.

This article will discuss the top Payroll Software. We’ll go in-depth about it, so you can understand differences and decide which one best suits your needs.

Best Payroll Software Follow for Growth of your Business

The best payroll software for your business should be chosen based on your specific needs and the size and complexity of your organization. Payroll software can help streamline your payroll processes, reduce errors, and ensure compliance with tax and labor regulations. Here are some top payroll software options that you can consider, which can contribute to the growth of your business:

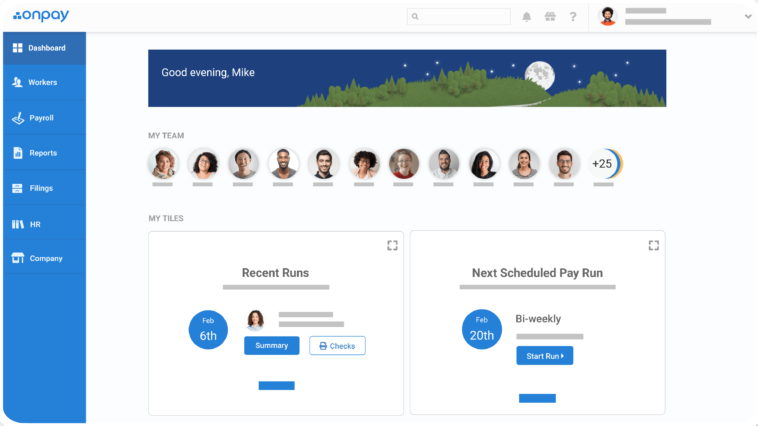

On Pay

On Pay provides Payroll and HR services at affordable prices. On Pay offers many features, including automatic payroll processing and tax file; support for businesses that want to operate from home; and more.

Features:

- Automated payroll processing and tax filing

- Direct deposit, cheque, or debit card are all options.

- Cloud-based and mobile-friendly software that can be accessed via mobile.

- Integration with other platforms is simple.

- Small businesses can use these features to help them work remotely. Examples include Employee’s self-onboarding, eSignature, and many other features.

Verdict On Pay is a small business software that is affordable and simple to use.

Price: $36 per month base fee, and $4 per person per month

Connect HR

ConnectHR.ae is a leading HRM software in UAE designed to streamline HR processes and enhance organizational efficiency. It offers a wide range of features, including payroll management, time tracking, HR support, and employee benefits.

Features:

Payroll Management:

ConnectHR.ae simplifies payroll processing with automated calculations, ensuring accuracy and compliance. It handles tax deductions, generates payslips, and supports direct deposit for employee salaries.

Time Tracking:

The platform includes an integrated time tracker that allows employees to log their hours efficiently. Managers can easily approve timesheets and monitor attendance, reducing errors and improving productivity.

HR Support:

ConnectHR.ae provides extensive HR support, including employee onboarding, performance management, and compliance tools. The platform helps businesses maintain up-to-date employee records and manage HR policies effectively.

Employee Benefits:

ConnectHR.ae offers a robust suite of employee benefits, including health and wellness programs, financial perks, and retirement plans. Health benefits cover medical, dental, and vision care, ensuring comprehensive coverage for employees.

Verdict:

ConnectHR.ae is highly recommended for its comprehensive features and ease of use. Users frequently praise the platform’s intuitive interface and excellent customer support. Reviews highlight its effectiveness in simplifying HR processes and enhancing employee satisfaction.

Price:

ConnectHR.ae offers flexible pricing plans to suit different business needs. The pricing structure is transparent and competitive, providing value for money. Specific pricing details can be obtained by contacting their sales team for a tailored quote.

By choosing ConnectHR.ae, businesses in the UAE can streamline their HR functions, ensuring efficient management and happier employees. As a top HRM software in the UAE, ConnectHR.ae is the go-to solution for modern HR needs.

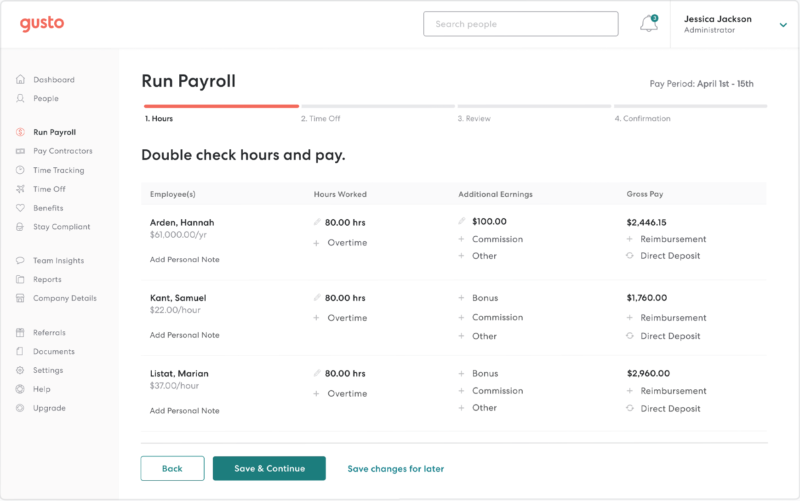

Gusto

Gusto makes it easy to manage your payroll. Gusto Wallet is the most popular payroll software. It offers many features, including a time tracker, payroll processing, HR support, and employee benefits.

Features:

- Gusto Wallet allows employees to save money for unforeseen situations. The amount taken is automatically deducted from the Employee’s paycheck.

- Gusto benefits include financial and health benefits. Vision and dental benefits are also included in the health benefits. Savings features, instant loans, and other financial benefits are just a few of the many financial benefits.

Verdict Gusto has been highly recommended. There are many glowing reviews. Most users praise the outstanding customer service and the user-friendly interface.

Price: Price Plans are as follows:

- Price: $6 Per Month per Person

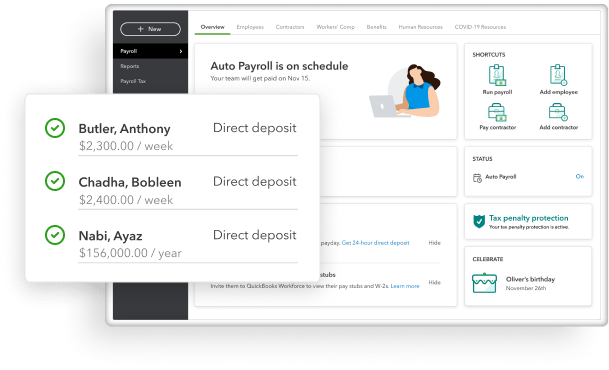

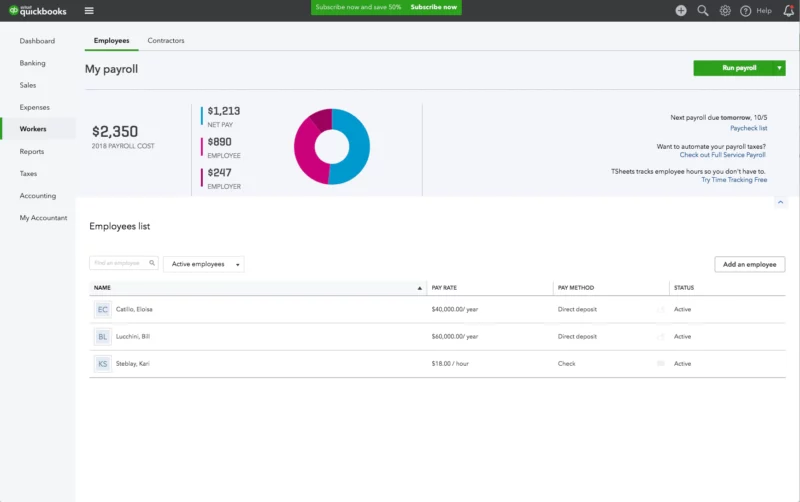

Intuit QuickBooks

Intuit QuickBooks accounting software is designed for small- to medium-sized businesses. Intuit QuickBooks offers many features, including payroll processing, tax penalty protection, and tax filing.

Features:

- You are protected from tax penalties with a maximum of $25,000.

- Tracks the hours worked by your employees, pays them on time and accurately, and creates invoices.

- Let’s make a direct deposit the same day.

- Pays the payroll taxes, calculates, files, and pays them for you. It allows you to maximize your tax deductions.

The easy-to-use features and excellent customer service make QuickBooks payroll a favourite among its users. QuickBooks has a relatively higher price tag than its competitors.

Prices There is a 30-day free trial. The following prices are as follows:

- Self-employed: $7.50 per month

- Simple start: $12 per month

- Essentials: $20 per month

- Plus: $35 per month

- Advanced: $75 per month

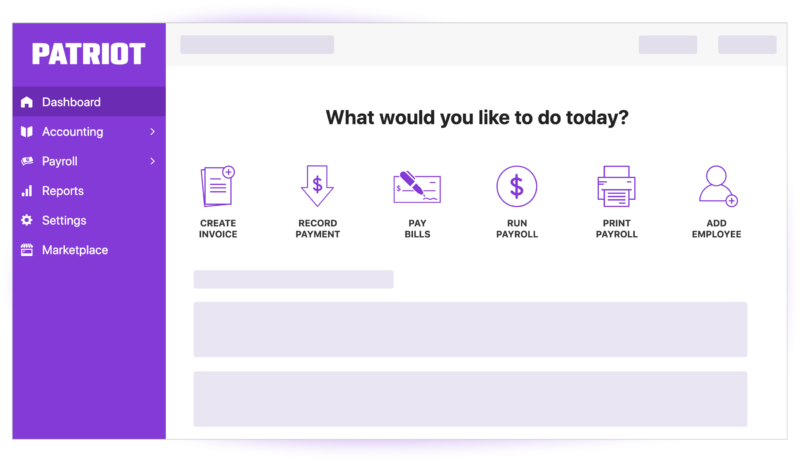

Patriot Software

American Software company Patriot Software provides small business accounting and payroll services. One of the most popular payroll systems offers many features, including unlimited payroll processing and easy integration.

Features:

- Each plan comes with expert support and setup.

- Unlimited payrolls are possible even with the basic plan.

- Easy integration with other platforms and mobile-friendly app

- Accounting features include invoicing, bookkeeping, accounting, and many more.

- Tax filing and employee benefits

Verdict: Excellent customer service, with constant improvements. The only problem is that there is no automatic time tracking for work hours. This feature is offered by many of its competitors.

Price There is a 30-day free trial. These prices are as follows:

- Online accounting plans start at $15 per month and $25 per month

- Online payroll plans start at $10 per month and $30 per month

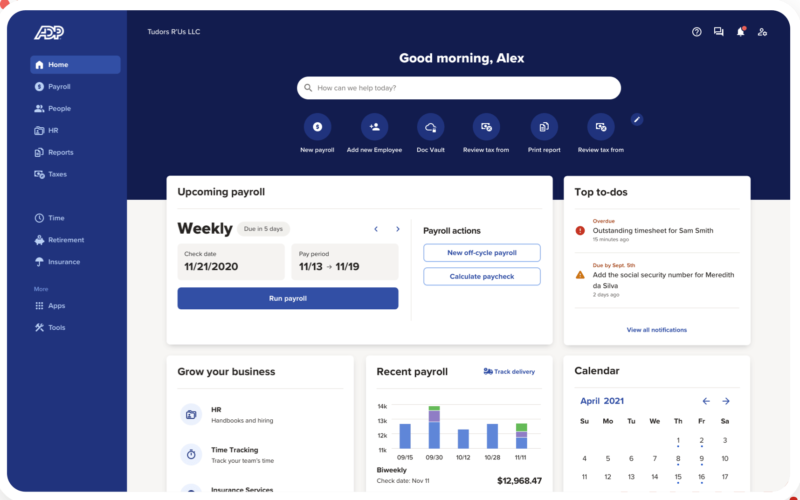

Run by ADP

Run by ADP payroll processing software is powered by ADP and offers small businesses free payroll processing for three months. There are many features available, including simple payroll processing and employee benefits.

Features:

- Payrolls can run on a mobile device or computer.

- Calculated and filed your payroll taxes

- To track time and get exact work hours, use the Time Tracker

- It makes it easy to board

- Benefits for employees include health insurance and retirement plans.

Verdict -Run by ADP has received many great reviews from users. They claim that the software works well and adapts it to their users’ needs.

Contact directly to receive a quote.

Work

Work is an easy-to-use and simple-to-use payroll software designed for small businesses. It tracks your employees’ work hours, attendance, files taxes, and more. This software is free for 30 days. After that, you will pay according to your choice of pricing plan.

Features:

- In just four clicks, you can run your payroll process.

- Let’s create payroll reports that include employees’ work hours, tax liabilities, and other pertinent data.

- You can watch both your state and federal tax filing to avoid penalties.

- It helps with the onboarding process. The new hires enter the information. All you need is their name, email address, and pay rate.

Verdict, The Work payroll system users love its easy-to-use interface. This software is ideal for small businesses, especially those who pay employees hourly.

Price There is a 30-day free trial. Pay $25 per Month plus $5 per Employee per calendar Month.

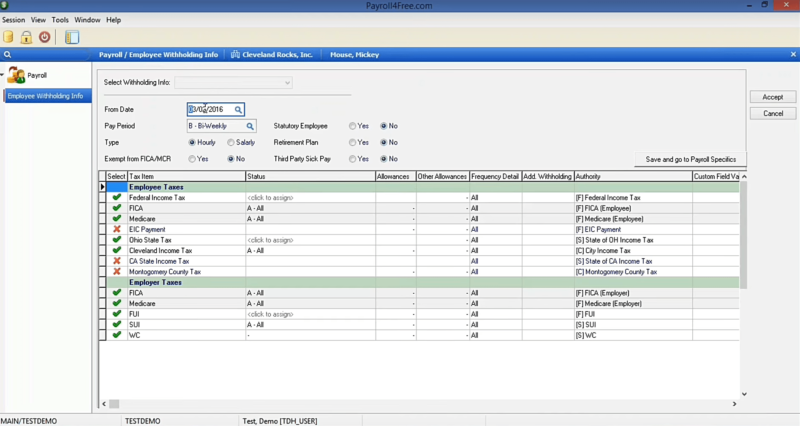

Payroll4Free

Payroll4Free, as the name implies, is free payroll software. Payroll4Free is free, and you don’t have to pay anything if payroll processing is required for more than 25 employees. The price plans will apply after that.

Features:

- Payroll processing up to 25 employees. Time tracking, tax calculation, and filing.

- This report contains detailed information about your employees, including their work hours, pay rate, benefits, and other pertinent information.

- Let’s make direct deposits or send cheques.

- These integration tools can send payroll data to other platforms or import time clock data.

Verdict, this free payroll processing software is highly recommended because it provides free basic payroll functions. It is simple and easy to use, suitable for small businesses.

Prices start at $12.5 per month

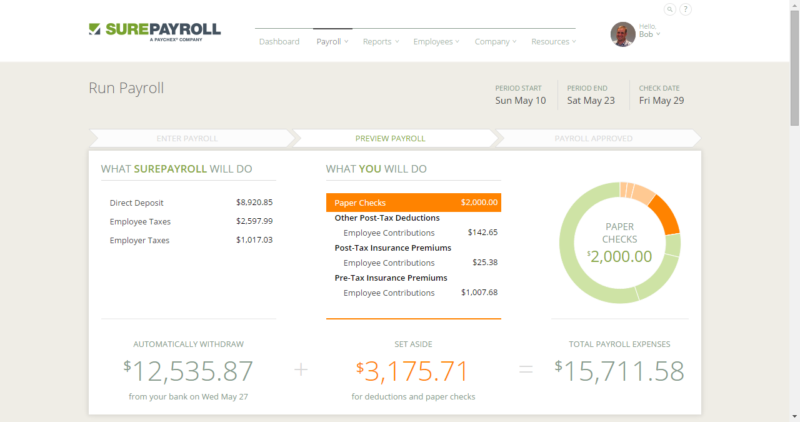

Sure Payroll

Surepayroll offers payroll processing capabilities for small businesses. It also gives you a two-month free trial. Software features include automatic payroll processing, benefits deductions, smart options such as Nanny share, mobile-friendly applications, and many others.

Features:

- You can also share a nanny with neighbours, relatives, or friends, and split the cost.

- Processing payrolls and accurately calculating wage garnishments, 401(K) deductions, etc.

- Offers affordable insurance for your employees.

- This tool will help you conduct background checks on your new hires before joining.

- The software handles tax calculation, filings, and payments.

The most popular features of SurePayroll are paying through direct deposit and integration with other platforms. It makes it a highly recommended software.

Contact directly to receive a quote.

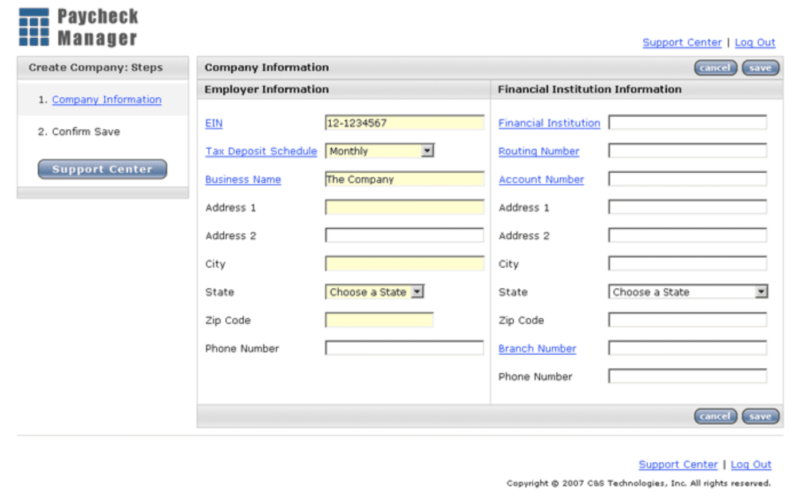

PaycheckManager

PaycheckManager, an online payroll, and tax calculation software offers a free three-month trial to all its users. This software offers unlimited payrolls and tax calculations.

Features:

- You can do unlimited payrolls and print checks for your employees.

- Accurately calculates both federal and state taxes.

- You can avoid late fees by filing your taxes before the due date

- Simple software interface to allow you to do your payroll processing.

Prices: Pricing plans are as follow:

- Basic: $5 per Month

- Managed Service: $12 per month + $2 per Employee + $10 Setup Fee

Verdict -PaycheckManager offers a simple-to-use tax calculation and payroll software at affordable prices. This software is highly recommended.

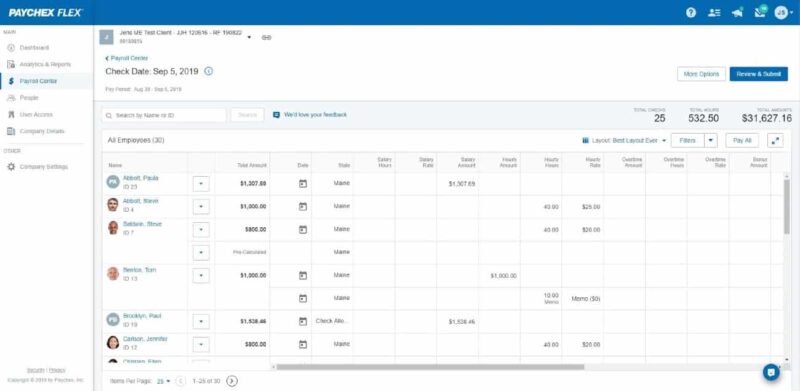

Paychex

Paychex allows you to manage your payrolls to concentrate on the important aspects of your business. Paychex offers many features, including payroll processing, tax calculation, and filing and payments.

Features:

- Simple, user-friendly software

- Payroll processing can be done in just two clicks

- Automated calculation of payroll taxes, filings, and payments on your behalf

- Mobile application free

- 24/7 customer support service

- Benefits for employees, including retirement and health plans.

Verdict: The Self-service Software saves a lot of time in the administration. It is also rated as one of the best payroll systems due to its customer service.

Contact the sales team to receive a custom price quote.

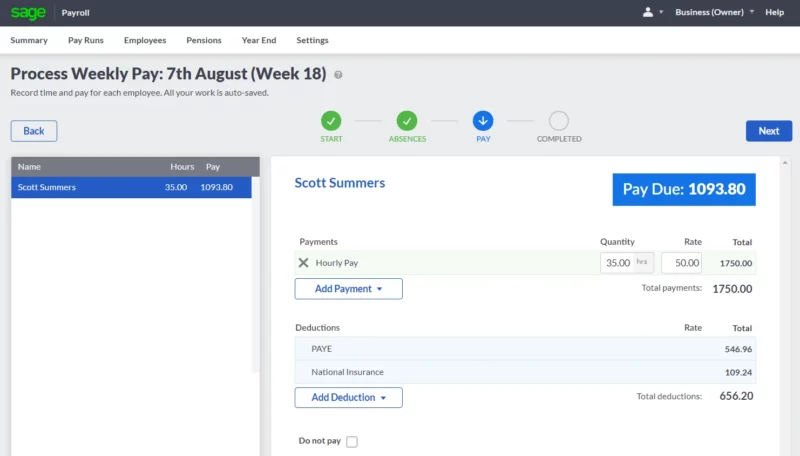

Sage Payroll

Sage Payroll is now owned by iSolved and provides payroll and HRM services throughout the United States. This software offers many features, including talent management, payroll processing, and tracking work hours. It also calculates benefits.

Features:

- Cloud-based payroll software that can be accessed from any location, anytime.

- Pay with direct deposit or by pay cards

- Self-service for employees saves you time and administrative costs

- 16 data centres are certified by SSAE for data protection

Contact directly to receive a quote.

Sage payroll is highly recommended for businesses.

According to reports, the software has become more user-friendly and smoother since it was acquired by iSolved.

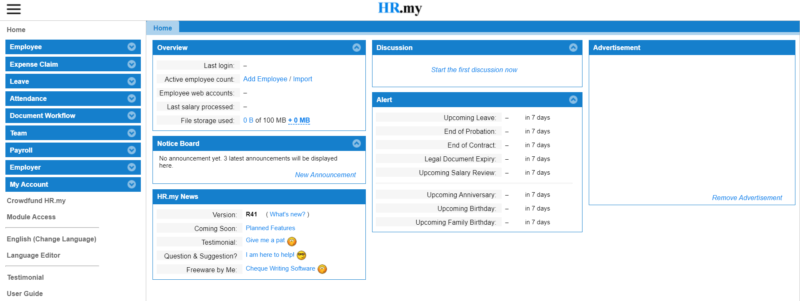

Hr.my

Hr.my software is completely free for all. Small businesses that want to reduce their administration costs will find the software most useful. This software offers many features, including leave management, time tracking, and SSL certification.

Features:

- Secure data with SSL certification

- Time clock to keep track of work hours and manage leaves.

- Salary processing for biweekly, weekly and semi-monthly periods

- Employee self-service program, including claims and leaves.

VerdictHr.my is recommended for small businesses. It is free to use. Some users complain about the outdated interface and lack of customer service.

Price: Free payroll software for small business

QuickBooks Payroll

QuickBooks allows you to organize all your financial information in one place, making it easy to complete common tasks faster. You don’t need to have accounting knowledge. Import your data from a spreadsheet.

Vendor Details:

Pricing: –

Pricing Option: Subscription or Free Trial

Business size Small.

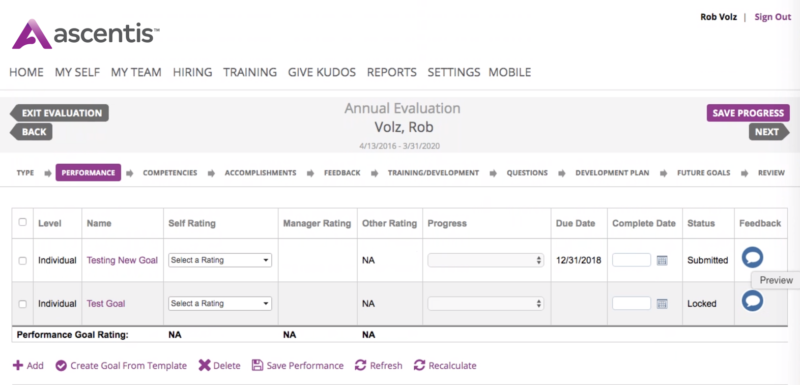

Ascentis

Ascentis HR utilizes web-based management software to automate complex HR processes. You can start anywhere. You can add any time. Ascentis is a leader in full-suite HCM technology platforms and workforce management solutions.

Vendor Details:

Pricing: –

Pricing option: Subscription.

Business size Small or Medium.

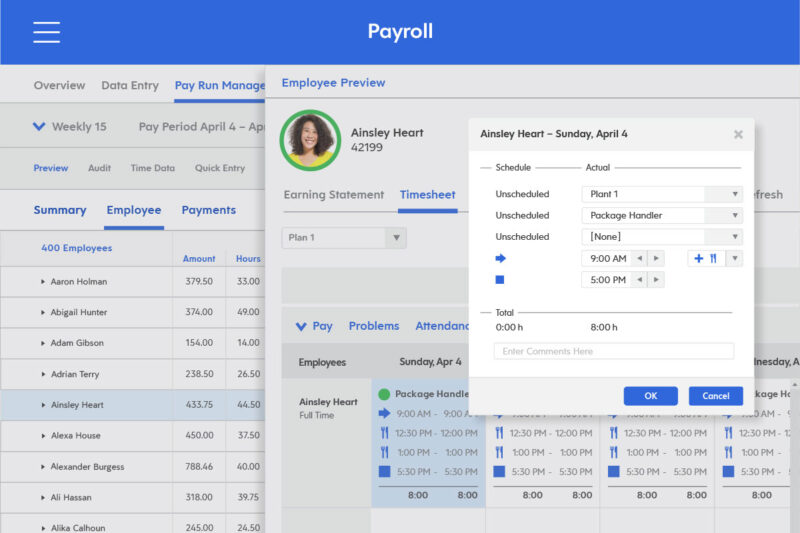

Ceridian Dayforce

Ceridian Dayforce HCM, a cloud-based platform, combines HR, payroll, and benefits. It also manages talent and workforce management. It offers real-time data, scalable frameworks, and continuous pay calculations to help you make efficient decisions.

Vendor Details:

Pricing: –

Pricing option: Subscription.

Business size Medium, Large.

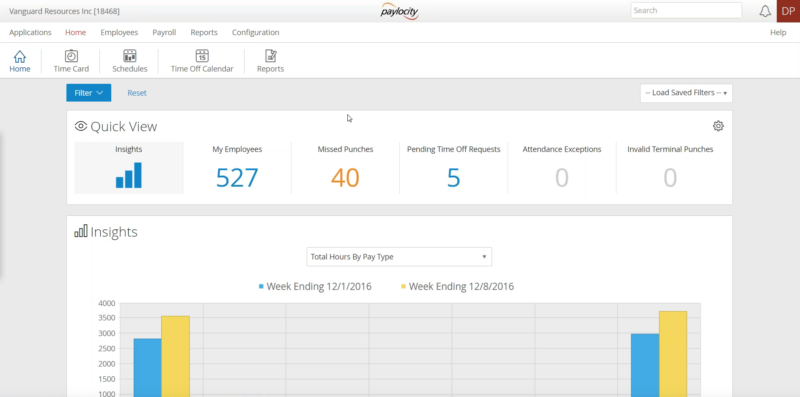

Paylocity

It’s a cloud-based payroll software solution that helps organizations optimize their processes. It offers many functions, like administration, time, and talent management programs.

Vendor Details:

Pricing: –

Pricing option: contact vendor.

Business size Small, Medium and Large

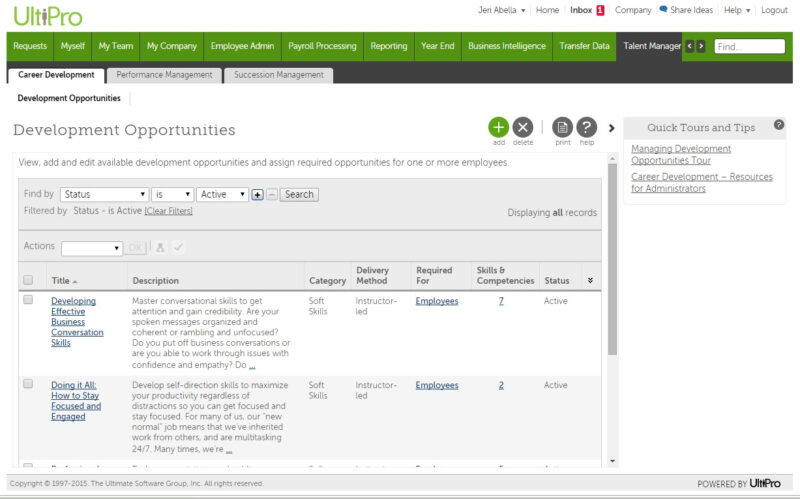

UltiPro

Ultimate Software is a well-known brand that offers cloud-based HCM solutions. Solutions can help businesses simplify payroll computations, speed up talent acquisition and manage strategic talent globally.

Vendor Details:

Pricing: –

Pricing option: Subscription.

Business size Small, Medium and Large

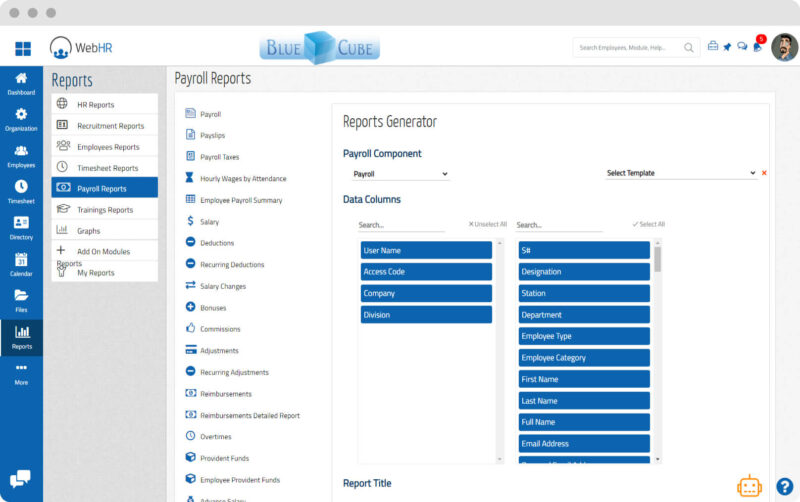

WebHR

WebHR, a cloud-based tool, can manage employees, payroll, and other related tasks. It supports more than 15 languages. WebHR is a tool that can simplify your daily tasks in the HR Department.

Vendor Details:

Pricing: $30/month.

Pricing Option: Free Trial, Subscription.

Business size Small, Medium and Large

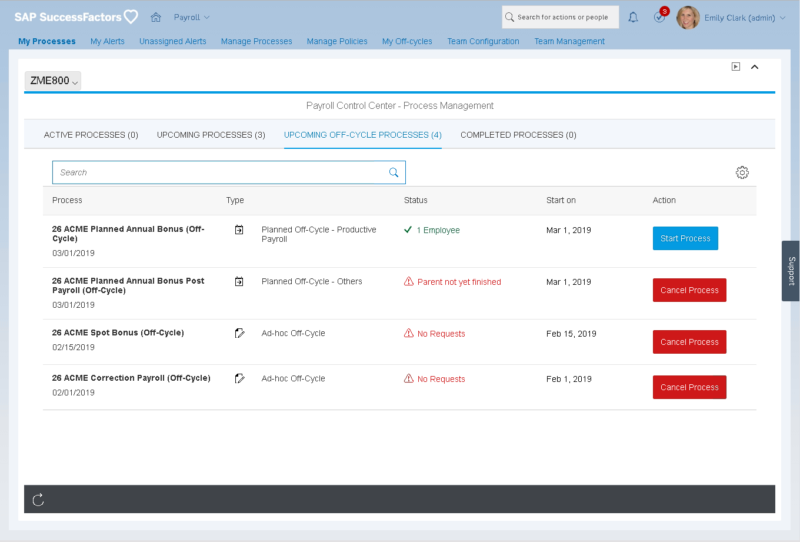

SAP SuccessFactors

SuccessFactors, a cloud-based integrated human resource management solutions suite, is available. It provides companies with all the tools necessary to manage their entire employee lifecycle.

Vendor Details:

Pricing: –

Pricing Option: Subscription, Free Trial

Business size Small, Medium and Large

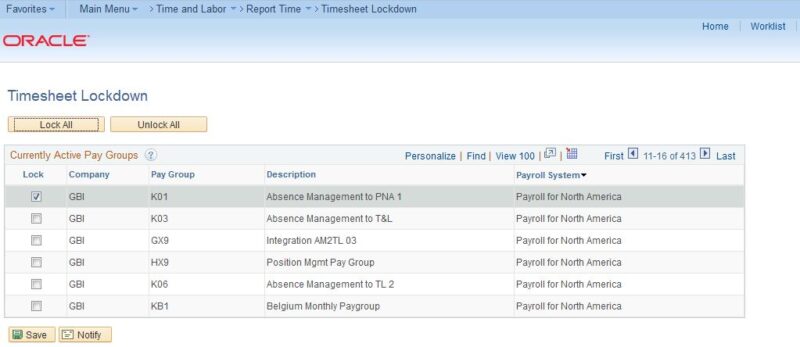

Oracle PeopleSoft HCM

Oracle offers an enterprise cloud platform to move PeopleSoft. Oracle suite includes Global Core HCM and Workforce Management.

Vendor Details:

Pricing: –

Pricing option – Free Trial, Subscription

Size of a business: Small to Medium or Large.

Why use online payroll software?

Payroll software makes it easy to manage information such as salary, tax deductions, and benefits. It also allows companies that use it to easily manage and track information on a large number of employees.

There are several reasons to use online payroll software. First, this type of software facilitates the operation of the payroll process within companies using online payroll programs, as it helps them manage hundreds or even thousands of employees. These companies may have an intra-company payroll service, in which wages and contribution deductions (such as Registered Retirement Savings Plan contributions) are automatically calculated in real-time and credited to the daily pay card or on a paycheck, then printed and shipped.

Businesses can use online payroll software to create personalized paychecks from a percentage recorded with a database or by using a specific template like self employed invoice template and entering personal data to create one. Personalized paychecks can be emailed or printed and used as a traditional paycheck.

Do you know what is Pay stubs? Pay stubs are important documents that help employees keep track of their earnings and deductions, as well as provide proof of income for various purposes such as applying for loans or renting an apartment check stubs creator instant online visit here and enjoy.

How to use online payroll software?

Payroll software is usually quite simple to use. All that needs to be done is that the employee information, such as name and address, must be entered into the system. Then, information about salary, tax deductions, and benefits can be added.

The best way to use the online payroll software is to start registering it from your client area. You will need to enter the worker’s personal information, such as name and address.

Information about his salary, tax deductions, and benefits could be added.

What are the benefits of using an online payroll tool?

Here are the benefits of using online payroll software.

1) It is easy to use.

2) Centralized information management.

3) Improves employee productivity.

4) It allows companies to manage a large number of employees.

5) Minimizes time spent on payroll administration.

6) The online payroll software is completely technology-driven.

7) The payroll process, communication, and traceability are updated in real-time.

8) Improves productivity and reduces costs.

9) Data security is enhanced.

10) Reduction of costs and time.

How can businesses use online payroll software?

Companies must first register all employees to collect personal data to use online payroll software. Then, this information must be entered into the software. The company must then add the data regarding salaries, contributions, and allowances according to the laws of their country.

Conclusion

We have reviewed both paid and free payroll software in this article. We also discussed what you should consider when choosing payroll software. Finally, we compared the top choices and reviewed each one thoroughly to help you decide which one is best for your company.