Users interested in financial services often start their search on search engines such as Google. Banks, financial advisors, insurance companies and other financial companies with a strong web presence often reach more consumers in their target audience.

SEO for Financial Services helps financial companies stay competitive, increase their trustworthiness and convert search engine users into customers. The following guide provides you with useful tips to market your financial products with search engine optimization successfully.

In short – the most important things about SEO for Financial Services & banking:

- The financial sector is highly competitive and characterized by high advertisement click prices.

- SEO helps financial services providers stay competitive and reduce marketing costs with free traffic.

- Google places higher demands on websites in the financial sector.

- Finance SEO helps website operators to identify the needs of the target group and provide suitable content.

- This can have a positive impact on clicks, rankings and sales.

What is SEO for Financial Services?

Search engine optimization for financial services (Finance SEO) is a digital marketing strategy to optimize the website of the financial company to improve positioning in search engines such as Google and receive more traffic from the target group. The measures used include those generally known for search engine optimization, such as keyword research, the creation of an intuitive page structure, the technical optimization of the website, and local SEO.

Successful sites rank better in search results and become more visible to people looking for mortgages, loans or advisory services. If the website offers the right content, it can increase trust in the bank or company and contribute to growth.

Challenges in Finance SEO

Although finance SEO is not fundamentally different from search engine optimization for other industries, there are sometimes special challenges in the financial sector:

- Special competition: Smaller and local financial service providers often compete with stronger competitors. These include national or international banks, insurance companies and large companies. Some banks and insurers also have local branches on Google’s local search results pages.

- YMYL: Google classifies content on financial topics as YMYL content (“Your Money Your Life”). This classification refers to websites whose information can affect the financial stability, health or safety of users. Since incorrect or misleading information can pose a high risk of damage, high standards apply to websites of financial service providers.

- Industry-specific requirements: In the insurance and finance industry, specific regulations must also be considered in search engine optimization to make the website legally compliant.

Proven SEO Measures for Financial Companies and Banks

Financial SEO uses a wide range of different methods that can be used by companies of all sizes, depending on the strategy. Measures such as content marketing and link building can help to strengthen the domain’s authority for financial topics and improve placement in search results.

However, it is not just about better rankings. The focus is more on visibility for the target group that is looking for suitable offers. Because only qualified traffic brings in sales.

Technical SEO analysis of the website

Before optimizing, it is important to analyze the status quo and identify potential. This will help you identify technical problems and estimate the effort required to optimize existing pages.

You can use SEO tools to keep track of the analysis and speed up the process. Complete solutions such as Ahrefs and Semrush offer a technical SEO audit as well as numerous monitoring and research options.

If you have a very limited SEO budget, the free Google Search Console provides important data such as clicks and average ranking. Many website operators use Screaming Frog’s relatively inexpensive crawling tool for technical SEO analysis.

Among other things, you should pay attention to these technical factors:

- Ensure all relevant pages are indexable (do not use the robots meta tag “noindex”).

- Ensure that all relevant content can be crawled by Google (do not exclude the bot with “disallow” in the robots.txt).

- Create an XML sitemap – e.g. www.your-domain.com/sitemap_index.xml – and list all important URLs. Also, store the sitemap in the Google Search Console.

- Use HTTPS and redirect all HTTP URLs via 301 redirect.

- Every relevant page should be well-linked internally.

- Also, check whether the navigation menu is intuitive and logically structured. Categories and the most important subpages should be directly accessible via the navigation.

- Check the loading times of the website. A fast page load time determines rankings and whether visitors stay on the site.

- The website must also function perfectly on mobile devices and be displayed accordingly. User-friendliness on mobile devices is an important ranking factor.

Conduct a Content Audit

The next step is to evaluate the quality of existing content and measure the past performance of your YMYL pages. Removing URLs that consistently rank poorly and do not generate traffic can also be helpful. These pages may generate poor ranking signals that can affect the entire domain.

Also ask yourself the following questions:

- Is the content correct and can it be backed up with sources?

- Is the content up to date and checked regularly?

- Does the site offer added value to the user and answer relevant questions?

- Is the website well-structured and easy to navigate?

- Is the text easy to understand and does it contain clear headings?

- Does each URL use unique and optimized meta titles and descriptions? These are displayed as snippets in the search results and are the first point of contact with the website.

- Is there only one web page for each topic or keyword, or are there duplicate or similar content problems?

Optimizing existing content often requires relatively little effort and can sometimes bring quick results.

Understand the Target Audience and Start Keyword Research

To create helpful content, you need to know the needs, problems and desires of your target audience. For example, suppose the website is aimed at financial services for young people and graduates. In that case, they will need different information and solutions than people looking for strategies for financial security in retirement. So think about what motivates your target audience.

On the one hand, these considerations form the basis for the subsequent keyword research. On the other hand, the research provides further insights into what users search for on Google.

Look for topics and search terms that:

- Match the company’s offerings and services.

- are actively searched for by users and have a high search volume.

- have as little competition as possible.

When analyzing keywords, pay attention to the search intent of the keyword. If the intention with which users enter the term into the search engine does not match the website’s content, your chances of ranking and the benefit of a ranking could be higher. Optimization is usually pointless if users are specifically looking for a specific offer or a competitor’s website.

Using tools like Semrush, Sistrix or Ahrefs, you can also find long-tail keywords (multi-word search terms) that provide a better insight into search intent. These include keywords like:

- “loans despite negative Schufa”

- “loan from private individuals without a bank”

- “What is an equity fund?”

Conduct a Competitor Analysis

You can also use common SEO tools to analyze competitors’ rankings and search terms for inspiration. However, you first need to find out who your biggest competitors are.

These do not necessarily have to be companies from the same niche. For example, a FinTech can offer similar financial services to a bank. In addition, you often compete in the search results with providers who sell different solutions for good rankings for relevant keywords.

You can use tools like Sistrix and Semrush to determine which domains your website already competes with. Additionally, a look at Google search provides further insights.

Once you have created a list of competitors competing with you for Google traffic, analyze their content and pay attention to the following:

- What content do competitors rank with for a keyword? (Guide, product landing page, etc.)

- What information does the site offer and how is the content structured?

- What do competitors do particularly well and what can you do better?

- Are there topics that the competition has not yet covered? Take advantage of such content gaps to rank in top positions faster.

Create informative content

To market your services and offerings, you undoubtedly use landing pages that describe the company’s financial products and services. But to succeed with finance SEO, your website usually needs detailed content that provides knowledge on related financial topics and answers relevant questions without an obvious sales intent.

Financial questions quickly overwhelm the knowledge of many people. Many users, therefore, look for content that will help them solve their financial problems. If your website has the right answers and presents them well-structured, you not only strengthen trust in the company but also strengthen your SEO and can draw attention to your financial services in a non-promotional way.

The benefits of informative content and guides:

- You position the website as an authority in the respective financial area.

- Satisfied users are more likely to purchase a financial product.

- You also reach users who are still looking for information about solutions and offers. If the website offers good advice, you can win them over at an early point in the customer journey.

- Google understands the domain better and may also rank it for related search terms.

- Particularly helpful content is often linked. Backlinks are a ranking factor.

Improve your local SEO

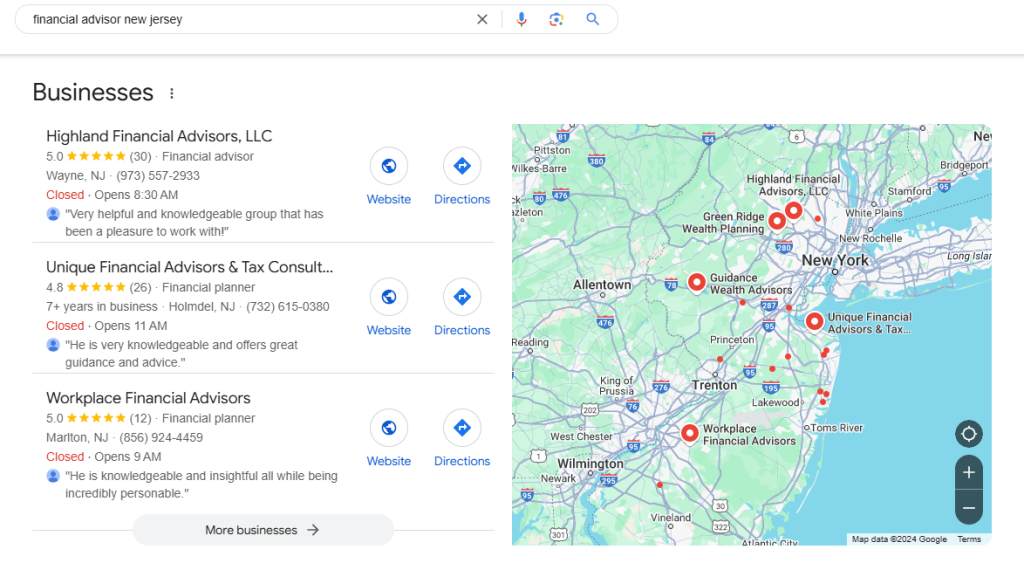

As early as 2020, a study by Trustpilot found that 76% of users who search for offers nearby on their smartphones visit a nearby company within 24 hours. Therefore, local search engine optimization is particularly relevant for regional or local companies and financial advisors. However, national banks and financial service providers are also driving the growth of their branches with local SEO.

Here are some tips for optimizing for local search results:

- Create a complete Google Business Profile for each branch.

- List your business in local directories.

- Make sure your name, address and phone number (NAP data) are correct and consistent in each directory, in your Google Business Profile and on your website.

- The area code of the telephone number should match the location. Therefore, enter the telephone number of the branch and not that of the head office.

- Research relevant keywords with local reference, e.g. “financial advisor new jersey”.

- Positive ratings and reviews from people strengthen trust in the financial company and the website.

Build Trust and Topic Authority

The content of banks and financial companies’ websites deals with complex topics that can affect the financial stability and well-being of site visitors. This means that content in the financial industry clearly falls into the YMYL range mentioned above. Therefore, The site must meet higher quality standards to achieve good rankings consistently.

The EEAT concept – Experience, Expertise, Authority and Trust – provides assistance in optimizing YMYL content. These are not ranking factors, but rather a pattern of thinking that can also be found in the guidelines for Google’s human quality raters.

The quality raters analyze websites, among other things, regarding their trustworthiness. However, their findings are incorporated into the design of the algorithms and, ultimately, into the calculation of the rankings.

According to the Quality Rater Guidelines, a trustworthy site is characterized by, among other things, content that experts with experience in the respective subject area have created. In addition, the website receives backlinks from equally trustworthy sites on the same or a similar financial topic. Good customer reviews are also a positive signal.

Therefore, Your goal should be to create high-quality, detailed content written by experts (e.g., financial advisors), based on real experiences, and offers enough added value that users and other domains link to your site and leave positive reviews. This will gradually increase your site’s topical authority in the financial sector. Also, remember to keep your content up to date.

In addition, other measures will help you:

- For more transparency, set up detailed contact and about us pages.

- Use author boxes and author pages with biographies and links to social media profiles to underline the expert status. For example, the authors’ years of experience in the respective financial sector should be mentioned.

- Strengthen trust in the website with independent customer reviews, such as integrated widgets from rating platforms.

- References in the text to trustworthy primary sources, such as legal texts, etc.

- Build links from authoritative sites that also deal with financial topics. Avoid backlinks from low-quality or off-topic websites.

Monitor Key Metrics

You can use the usual SEO KPIs to measure success:

- Average position: With the Google Search Console, you can monitor the rankings of each URL. It is advisable to monitor the positions of the most important keywords regularly and to summarize the data clearly in Google Looker Studio, for example. The Google tools offer the necessary interfaces for automated data export.

- Impressions and clicks: The GSC provides reliable data on how often a page was displayed and clicked in the search results. The results can be filtered, for example, at the keyword level or by the device used.

- User behavior and conversions: With Google Analytics, you can understand how visitors behave on the website. The URLs and navigation paths accessed, the bounce rate and the conversion rate are relevant here.

Backlinks: It is not just the number of backlinks that is important, but especially their quality. Links from low-quality and irrelevant pages can hurt your rankings or are simply ignored by Google. The link position also determines the value of a backlink, the anchor text and the timeliness of the link source.

Conclusion: SEO is crucial for banks and the financial industry

The financial sector is highly competitive. SEO is, therefore, a crucial investment in the competitiveness of banks and insurers as well as smaller financial service providers with a local focus. With the right strategy, finance SEO helps to promote the company’s sales and growth as well as strengthen trust in the brand.

When developing their marketing strategy, website operators should remember that SEO is not a short-term project but an ongoing process. It can also take several months for the measures to take effect. This is due, among other things, to the high demands that search engines such as Google place on websites in the financial sector.

However, patience and perseverance are rewarded, because as soon as the website achieves relevant rankings in good positions, it generates free traffic. Given the often horrendous click prices for paid advertisements in the financial sector, SEO can help banks and financial service providers to reduce their marketing costs in the long term.